Saskatchewan falling behind in competitiveness

Tax and regulatory regime for potash hindering competitive position, many in industry say

September 22, 2020, 12:00 pm

Kevin Weedmark

Editor Kevin Weedmark recently spoke with Tyler Hopson, Public Affairs Manager with the Mosaic Company, about the competitiveness of Saskatchewan’s tax and regulatory regime for potash.

How important is the potash industry to Saskatchewan’s and Canada’s economy?

It is a big industry and it is very important to Saskatchewan’s economy.

Canada at the moment is still first in global potash production but there are other countries that are catching up to us pretty quickly and have the potential to overtake our production numbers.

Potash contributes over $5.5 billion to Canada’s GDP every year.

We know that for every direct job in the potash mining industry there are at least two jobs in the supply and service sectors that support the industry. The potash industry pays approximately a billion dollars in wages every year, so they’re some pretty big numbers.

When it comes to Mosaic doing a project like K3 for instance in Esterhazy, what sort of factors are weighed when you decide whether to do an investment of that size?

Well, I think you’ve got to look at it from a lot of different view points as broadly as you can—the ore body itself, the geological aspects, are important—the particular grade of potash that you’re dealing with and the amount of the resource—but you have to think about it from other points of view too as well.

What does the transportation system and the logistics look like for getting products from the mine to where they need to go?

What is the labor pool and availability of people to come and work at a new mine?

Then costs overall for operating is another big factor. You need to know the tax structure that’s in place and any pending or potential regulatory changes.

The ease of getting project approvals done can be another factor that companies look at—whether is it going to take three, five, 10 years to get the project for all the approvals—those things all start to matter when you look at it as a total picture.

What are the advantages in Canada compared to other jurisdictions and what are the disadvantages right now?

Canada has lots of advantages. One advantage is the ore body and the quality of our mineral reserves. In the case of potash and lots of different minerals, the quality of the ore and the amount of the reserves are very good. We have ample supplies.

We have hundreds of millions of tonnes available to us, so that is a real advantage. We have overall a stable operating environment, and as far as the people side we’ve got great schools, great training institutions, and so we know that we’re getting talented people to work here.

We’ve been doing some research over the last few years at Mosaic. As we’ve been talking about environmental issues and trying to evaluate things like reducing greenhouse gas emissions we know that Canada already has some of the lowest rates of greenhouse gas emissions, as far as potash production goes.

We have a green environment and we are working to make that even better as we navigate programs the federal government has created to help us reduce emissions even further, and I think in Saskatchewan and probably most of the country there’s more and more expectation that companies give back to communities. It’s not really optional to do that sort of thing. You need to be invested in communities and contributing to the causes that communities care about, so I think we’ve always done a pretty good job of that at Mosaic and lots of other companies in the mining sector do too. So those are some of the advantages.

What would be some of the disadvantages?

One would be transportation—getting our products from the mine to where they need to go. Saskatchewan is a land-locked province so we have long distances to travel from mines to ports.

That can add significant cost of production for companies. Mines in other parts of the world may be closer to some of the major markets that we export to, like India, Brazil, China, and they may have cheaper options or more reliable options available to them.

For the last few years we’ve seen fairly regular service interruptions in railway service, whether it’s poor winter weather or strikes or blockades.

There have been a number of factors that make it hard to predict and can add time and add cost to getting products where they need to be—so that’s one disadvantage.

Overall costs are higher in Canada.

It’s important to us that we have great jobs in the potash sector and we do offer really attractive careers for people. We do make sure we treat employees well as it’s expected of us and that’s something we want to do of course—but it does add a cost complexity that in some other parts of the world there may be less attention paid to working conditions or wages.

It’s not a disadvantage but it is an additional cost that we shoulder.

In Canada there have been changes to some of our tax and regulatory systems over the last several years.

Either new costs added onto our production or additional regulatory hurdles to cross—competitors in other parts of the world just don’t see those same costs.

Can you explain to me how the regulatory system in Canada works for potash? Is it entirely under provincial jurisdiction because it’s a resource or is there some federal jurisdiction as well?

We are mostly under provincial jurisdiction as far as advancing a project of building a new mine.

Where the federal government is involved is more so on environmental matters, so of course we have the added cost of the carbon tax. It’s been a big topic for the last number of years of course.

Are you strictly taxed provincially?

That’s where it gets complicated. There are property taxes, a resource tax as well as royalties paid, then of course income tax, consumer taxes like GST and PST, so there are a variety of different layers of taxation. The major ones are the resource tax and royalties paid.

How have those changed over the years?

There has been changes. They do tend to change from time to time and we have seen increases certainly on those fronts in the last number of years

Of course we want to pay our fair share but we always try to remind the government to be mindful that we are in an international operating environment and have to be aware of what other potash producers may or may not be paying in different parts of the world.

Does it impact your competitiveness when you have the taxes you do?

Yes it definitely can impact competitiveness. At the end of the day the price of potash is the same on the world market no matter where it is made.

So if a producer can come in at particularly low cost per tonne and bring home more profit at the end of the day which they can redistribute of course to their communities and their employees and reinvest back in the company, that is an advantage for them.

At this point in time there is no incentive or reward for the producer that is the most responsible or the most sustainable—you get the one global price for the commodity on the market.

Do companies like Mosaic have ongoing conversations with the various levels of government about competitiveness and what it takes to ensure that there is more investment in potash in the future?

Yes we do. Whenever we have an opportunity to have a consultation with any level of government we make a point to discuss those pieces and help make sure there is an awareness of what the operating environment looks like on a global scale for the potash sector—what the opportunities and also the challenges are.

When you did have a whole new tax come in like with the carbon tax, and that is something that is going to be adjusted, does that particular piece on its own impact competitiveness?

You have to look at the total picture, of course. I think it does have some impact. The carbon tax for example is paid on electricity in Saskatchewan so that can have a fairly noticeable impact for companies that require a lot of electricity to run their operations, and mining is one of those.

If everyone had a carbon tax around the world it wouldn’t be such a factor, but because each country is taking their own approach this is something we have to be mindful of.

The other piece is the regulatory uncertainty. It’s hard to predict what the carbon tax may look like in 10 years, what dollar amount that could be at that point at times, so that makes it a little bit harder to make decisions about future investments, and you could say that about any taxes but that is just one topical example.

With the current tax and regulatory regime in Saskatchewan right now, does it encourage or discourage investment in the industry?

We think it’s time to review royalty and tax treatment to look at accumulative impacts over the last five to 10 years and to benchmark Saskatchewan against not just other provinces but internationally.

That would be one of our big asks, is for governments to do that sort of comprehensive look when they are contemplating an increase.

There are still a lot of great reasons to be here and to operate in Saskatchewan, but every time there is an increase we do have to examine that competitiveness position once again, and if there are too many increases then absolutely it is harder and harder to make a case to invest in Saskatchewan.

Have you gone to government with that message?

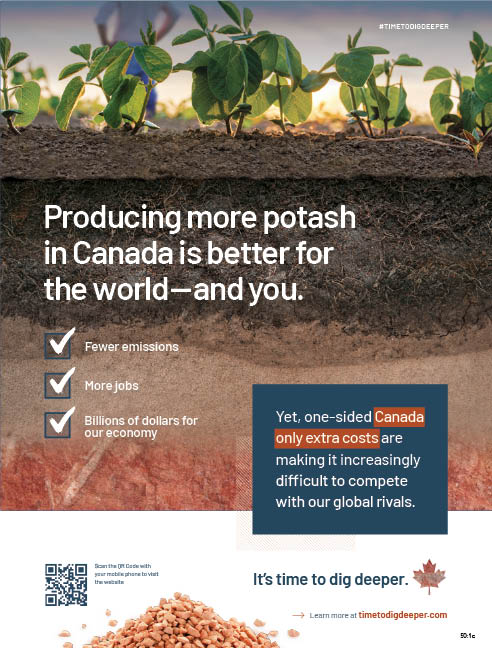

Yes, we have shared that message and the Saskatchewan Mining Association would be amplifying that message from its members, of which we are one. Mosaic led the creation of the Time to Dig Deeper campaign, but some of our industry association partners are helping to share that message as well to create more awareness and more dialogue around the challenges that the industry is facing.

What is the main message you are trying to get through with the Time to Dig Deeper campaign?

We have a great resource and a good story to tell for Canadian potash. It does a lot of good not just for food security but for the communities and areas in which we operate. I think people are aware of that, but maybe less aware of what some of those challenges are that are threatening the industry’s future in Canada. We are trying to create a bit more awareness of the ways that producers outside of Canada can take advantage of their own operating environments and further benefit their industries, which is their right to do, but we have to think of how it impacts us here as well.

Are you getting any feedback on the campaign?

We have a little bit. We’ve started to get some questions as we’re sharing the message on social media.

We are creating some dialogue. We are getting some good engagement I think from the areas where we operate and we have started to have some conversations with government as well as they try to learn more and to understand some of the points we’re raising.

Best case scenario, what would you like to see from the government?

We think it’s time to look at the cost environment, review royalty and tax treatment and be very mindful when introducing any policy or regulatory change that might add more costs about what that could do to the competitive position of our industry.

We would like to see improvements to transport infrastructure and systems in Canada.

Any sort of action the government could take that would help improve the cost position without eroding any of the safeguards or the systems we have put in place to make sure we have strong performance, we would certainly welcome.

Tweet

Tweet