Study shows carbon tax would hurt GDP

June 28, 2018, 5:07 am

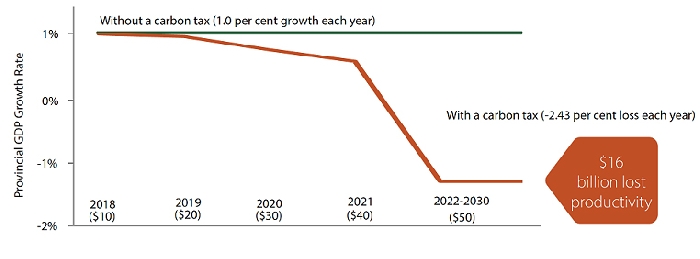

According to a new analysis from the University of Regina’s Institute for Energy, Environment and Sustainable Communities, a federal carbon tax could potentially reduce Saskatchewan’s gross domestic product (GDP) by almost $16 billion, with little effect on emissions.

“The federal government has significantly underestimated the economic impact of its carbon tax and overestimated the expected Greenhouse Gas (GHG) reductions,” Environment Minister Dustin Duncan said. “This new and more thorough model indicates GDP reductions in the billions, which translates to less competitive industries in Saskatchewan and fewer jobs across the province. This is exactly why our government has never supported the tax and is challenging it in court.”

The Government of Saskatchewan, in conjunction with researchers from the Institute looked at several detailed scenarios of a federal carbon tax. The most conservative scenario shows a carbon tax of $50 per tonne would reduce provincial GDP by 2.43 per cent or $1.8 billion annually. Total impact to the provincial GDP could reach approximately $16 billion from 2019 to the end of 2030.

The study also looked at the potential environmental impact of a federal carbon tax and found it will only reduce GHG emissions by less than one megatonne. This is approximately 1.25 per cent of Saskatchewan’s total emissions and would result in a cost to GDP of $1,890 per tonne.

In addition to significant impacts on provincial and national GDP, research conducted at the University of Calgary confirms a federal carbon tax will cost an average Saskatchewan household more than $1,000 per year.

The federal government has not incorporated specific provincial economic data in its modelling. Saskatchewan exports more than any other province as a proportion of its total GDP. In 2017, Saskatchewan exports made up 47.7 per cent of the provincial GDP.

“The federal government has not accounted for energy-intensive, trade-exposed industries that drive our economy and has not told Canadians what they will be paying or what little impact that price will have on emissions,” Duncan said. “Our strategy will enhance our resiliency to climate change, result in actual emissions reductions, and ensure our industries remain competitive.”

Saskatchewan’s climate change strategy, Prairie Resilience, includes SaskPower’s commitment to achieve up to 50 per cent electricity capacity from renewable resources and reduce overall GHG emissions by 40 per cent by 2030. This will result in GHG reductions of approximately six million tonnes.

In addition, upstream oil and gas producers will reduce GHG emissions by 40 to 45 per cent through a methane reduction strategy, which will result in reductions of 4 to 4.5 million tonnes.

Prairie Resilience also recognizes the prominent role of agriculture in addressing climate change and reducing emissions. Producers already sequester nearly 12 million tonnes of carbon through innovations such as zero till technology.

Further reductions are expected from large industrial emitters as the performance standards are developed. Saskatchewan will make these significant reductions in GHG emissions without a carbon tax.