Anger comes out at public meeting

January 17, 2017, 2:07 am

Kevin Weedmark

A lot of anger was expressed at a public meeting on the closure of RBC’s Wawota branch Thursday evening.

At one point Wawota Business Enhancement Group president Shannon Houff asked everyone to stand who was moving their accounts from RBC because of the closure, and almost everyone in the hall stood up.

“What happens when we are at the Bigway grocery store in town and are having some trouble with our debit card?” she asked. “What if we try again a couple of times and it doesn’t work, and we need to get it repinned. We have to drive to the Moosomin branch.

“We get a new Visa or Mastercard in the mail and we need to put a new pin in and a different password to activate it? We get to drive to the Moosomin branch.

“Where do businesses go to get coins and cash for your daughter that needs something from that little garage sale we have in town and she needs cash? They have to drive to the Moosomin branch.

“What if we need to deposit cold hard cash today? We need to make a trip to the Moosomin branch.

“What if I sell my cows today and drive to Virden and I get that $75,000 cheque and I want to make a payment on my business line of credit and days mean money. There would be a hold put on my cheque I’m sure when I put it through your little machine.

“It would be a lot more profitable if I went straight to the branch and put my money in to my account, so again I’m going to drive to your Moosomin branch.

“So if you take just these five examples that I have given you and consider it is about 57.5 km one way to Moosomin, so a total round trip of 115 km. If you go with a typical 52 cents a km for mileage and wear and tear on your vehicle, each trip to the Moosomin branch would cost us about $60. So it is not going to take much for most of the people in this room to spend about $1,000 a year minimum. Not only is cost a hard pill to swallow, when they leave our community they will probably do some other shopping at the grocery store, the greenhouse, the hardware store, they will grab some gas in Moosomin.

“This really hurts the Wawota businesses. But what most people including the banks do not realize is that it hurts each individual in this room.”

“When you don’t have a viable business core in your town your once $300,000 home—which in some people’s cases is their retirement money—is now only worth $150,000 and it takes six years to sell it. If you don’t believe me ask our neighbors in Kennedy. This also affects the banks, because now all of us will have less money to invest with you.

“So RBC has been taking and using the money of our residents of this small community and rural residents for the past 104 years. RBC has been making a profit on it for all this time and it has got RBC to the success they are now at. Now you are lending our money to the people of the larger centers who we all know don’t have as much in the way of personal health and assets of a lot of the people in a small community. RBC is taking away our services and giving it to them. The services to the people that got you in the position you are in interestingly.

“I believe that one day that really truly will make an impact on RBC and you wonder why more rural and community minded financial institutions like FCC and the credit unions are among your biggest competition. Do you want to know why? They care about our lifestyle. They choose to be a part of our communities by having a physical face in our community. A physical presence in our small towns. So I stand here and tell you, RBC, please don’t bother coming into my personal business and chatting about your new services.

“As you have decided to remove services I have decided to support my community by moving all my investments and money to a bank that is present in my community, so save yourself a trip to my business. I’m sure your volume percentage that you spoke about so much the other day will go down when this entire community does the same.”

Wawota resident Jeff Howe said the more he thinks about the bank closure the more he opposes it.

“When this issue first came up, to be honest my knee jerk reaction was ‘sure, makes sense.’ I for one do most of my banking online these days and I’m sure I represent a majority of your clients,” he said.

He said as he looked further into the issue, he found that RBC lists its business purpose as “helping clients thrive and communities prosper.”

“Also on your website, it states RBC is Canada’s largest bank by market capitalization,” he said.

“I’m looking at a media release on your website from RBC July 28, 2016 with respect to the JD Power Ranking: ‘RBC is recognized as the highest ranked Canadian big five bank for customer satisfaction. This recognition speaks to our commitment to clients and our ongoing efforts to put them first, said Jennifer Tory, Group Head Personal and Commercial Banking,’ ” said Howe, quoting the news release. “ ‘As our clients’ lives and routines change, we are continually working on ways to provide exemplary service and to make everyday banking easier, whether it is in our branches or local community, on the phone or through online or mobile . . .’ Then the end of the news release says ‘our goal is to serve our clients where and when they want, enhancing their overall experience and building long lasting relationships.’

“I am looking at Canadian Investor 500 Stock Ranking as of the end of the first quarter 2016. As of May 6, 2016 RBC was 7th in Canada, with revenue of 35 thousand million dollars ($35 billion). I don’t even know how much that is but it’s a bijillion. Canadian Business ranked the top 15 companies in Canada by profit and guess where RBC is on that list? Number 1 in Canada. $9,917 million dollars last year ($9.9 million). You guys represent the most profitable company in our country.

“The last page I chose to pull up is also on your website and it’s entitled ‘A conversation with the president and chief executive officer of RBC.’ For most of you who don’t know that’s Mr. Dave McKay: ‘RBC recently articulated its organizational purpose as “Helping clients thrive and communities prosper.” Can businesses really do both? I believe they can and must do both. Clearly as a financial institution our purpose has to include helping clients succeed. That is one of our most important economic impacts. We also want to have a positive social impact and that means investing in people in the fabric of our communities. This includes the jobs we create, the taxes we pay, the businesses we lend to, the suppliers we buy from, the organizations in which we invest through donations and where our employees volunteer. It’s critical that we consider our social impact at the community level that broadly.’

“I began by saying my knee jerk reaction about this was no big deal but that was kind of a self serving or selfish mind frame I was in, and then I started to think about my 95-year-old grandmother. She doesn’t live in Wawota but she likes to go into the branch where she does live. I see on your website that about only 20 percent of your clients like to use the branch, sort of a national statistic, well that 20 percent isn’t people like me in many cases, it’s people like my 95-year-old grandmother. It’s vulnerable people, it’s disabled people, it’s the elderly, it’s maybe the 17-year-old high school student who is not supposed to be on the internet very much, it’s any number of people that value the branch service.

“What about them? The 20 percent that get marginalized when decisions get made should not have to take a back seat to the business decision. When we talk about corporate responsibility, these are the sorts of things that come to mind. There is a responsibility as the largest corporation in Canada, the wealthiest corporation in Canada. There is a responsibility to have boots on the ground where and when you can. There is a responsibility to lead by example. You’re king of the hill. You make more money than any other company. The king of the hill, if it wants to be a good corporate citizen and it wants to exercise corporate responsibility, must lead by example.

“You can’t just look at the business decision from the perspective of ‘well our branch isn’t making much money anymore for the region.’ The business decision has to incorporate all these other aspects that are less tangible than the balance sheet.

“Just because you can point at this branch and say it’s not making money doesn’t mean that the logical business decision is to shut it down. I was a bit disconcerted when I came in tonight and one of the first things I heard from you is ‘the decision has already been made, we’re not here to debate it.’

“Is that how a leading corporate citizen thinks and talks to communities? Is that really how RBC wants to be seen as operating? ‘We are doing this. We’ve already decided it.’ The first thing that pops into my mind is: Well what are you doing here?

“It isn’t necessarily a foregone conclusion that you’re leaving and I beg you to reconsider and I would suggest, sir, when you are looking at all of this, your obligation to all of the people in this area is to fight for the branches staying open when and where you can. It isn’t to just look at the balance sheet and determine that owing to the lack of profits coming out of the branch it’s better for it to just shut down.

“I think there is a bigger story at play here. It is not just about the RBC branch closing in Wawota although that is obviously in front of us right now. The bigger story here is what is happening across Canada and with lots of branch closures in lots of rural areas

“I would suggest that the correct business decision is to keep them open. RBC is number one, the rest of the banks are all in the top ten in Canada, and you all as the biggest companies in our country have an obligation as corporate citizens to lead by example.

“What kind of message are you sending to the people in these communities when you shut operations like this one down. What messages are you sending to the other small businesses in town? They watch you as the biggest kid on the block. They look at you as king of the hill and whether they want to admit it or not they look at companies like yours for leadership and guidance and when they see you pulling out they start scratching their heads wondering whether they want to be here or should be here. Having RBC in these little towns lends an air of credibility to the town itself. If you want to call this a business decision, then in my humble opinion you have made the wrong decision and the correct business decision would take into account far more than just the profitability of the branch

“I’m sure there are alternatives to branch closure, and I’m equally sure that this bright team that you have could figure something out if they were put to the task. Whatever you have been doing hasn’t been working.

“I’m suggesting that closure is not the right decision and urging you to revisit the issue. Thank you for coming to speak with everybody and opening it up for a discussion. It would be really nice to hear you say that you are willing to continue to consider the issue.”

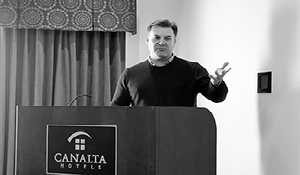

RBC regional vice-president Ed Kaulbach took full responsibility for the decision to close the branch. “It was my decision to close the branch, just as it was my decision to keep it open for the last five years,” he said. “It rests on my shoulders.”

Kaulbach said after the meeting that he wasn’t surprised to see the strong opinions expressed at the meeting. “The people of Wawota are very passionate and it has been a privilege to be part of their community and we will continue to be part of their community,” he said.

While some national banks have laid out plans for rationalizing their branch networks across the country, Kaulbach says RBC doesn’t have a specific plan for branch closures.

“We take a very measured approach to adjustments to the branch network. I do foresee that we will have less branches moving forward. We do not have a mandate to go out and close 50 branches or 10 per cent of our branches or anything like that. Most of our clients deal with us online. I do see a day when we don’t have as many branches as we do now but I don’t have a mandate to close a bunch of branches.”

Kaulbach said it was a difficult decision to close the Wawota branch. “Wawota’s very difficult for me because for the last several years I’ve looked at it every year to see if it still makes sense to have a branch,” he said. “It was very difficult because I have been a part of this community—from afar—for five years. My staff here I have been particularly impressed with and particularly proud of. So it wasn’t easy. I have to run south Saskatchewan like a business and I have a responsibility to make tough decisions, and with less and less people coming in the door, at a certain point you need to make a decision on do you need that branch anymore. I have lost some sleep over it. Sometimes the right thing to do isn’t the easiest thing to do.”