Strong future seen for potash in area

January 8, 2021, 9:53 am

World-Spectator editor Kevin Weedmark recently interviewed Larry Long, Senior VP of Potash Operations with of Nutrien, about the future of the potash industry in the area:

What does Nutrien see as the long-term role of Nutrien Rocanville within the company?

Rocanville is a very important part of the potash business unit. Obviously it’s our largest operation, one of the largest potash mines in the world. Our major customer out of Rocanville is not exclusively the U.S., but a lot of the product goes down into the U.S. They purchase close to 50 per cent of our production.

How has that changed over the years? Has it become a larger percentage?

Yes it has. When I was a GM in Rocanville, it was towards the end of the expansion. They were still one of our bigger sites, but not to the level they are now. But during the expansion we increased the capacity. It has probably close to almost doubled. It’s around 5.2 million tonnes. So it was quite a significant increase in production.

And why was that done? What’s the difference with Rocanville and some of the other sites that they made that massive investment at Rocanville specifically?

Well we did invest at all of our sites. It’s just that the ore body, the part of the Potash basin in the Esterhazy/Rocanville area doesn’t have clay seams in it. Our operations are very productive there, and I don’t think it’s any different in Esterhazy, because the clay seams and the geology is more favorable in that region of the potash basin in Saskatchewan. It’s more mining friendly underground.

The project which added the shaft at Scissors Creek added a lot to Rocanville’s capacity. Are there any other major projects or upgrades planned for the next few years?

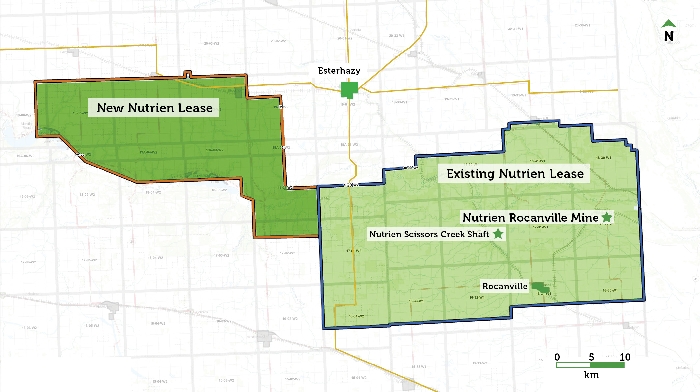

Yes, not immediately, but we’re always looking and doing long-term planning. And Rocanville is still a significant part of that. We’re always looking at our future mining plnz. In regards to the lease that we signed with North Atlantic Potash, that was a Crown lease, we purchased it for them. So that will extend Rocanville to the west.

So how did that come about? Was that a long-term negotiation?

It’s a Crown lease but North Atlantic Potash had staked that lease, so it was theirs. Internally the business decided that they weren’t going to develop it. We negotiated to purchase it from them and the Crown approved it. That took a while to do. That adds decades of production to Rocanville.

How long-term is Nutrien looking with that purchase? Is that something that will be developed a decade or two or three into the future?

Yes, I would say a decade to two decades roughly. In our normal course of operations we have what we call our production panels, but then we also have our development. And development is always where we cut our main travelways and our underground belt access, and those are parallel tunnels that we’re cutting.

And then from that what we do is, we start roughly perpendicular to those main entries into the new area. Then we cut perpendicular travelways, and then off those we start cutting our production panels.

We kind of categorize it as developmental cutting and production cutting. But there’s the primary development, where you’re putting your main access in your main beltlines into a new area. Then you kind of turn off that—it’s not always 90 degrees but Rocanville for the most part is 90 degrees—and then you develop your belt lines and travelways into the new areas. Then you start cutting panels off of that which are perpendicular to that secondary main travelway.

It takes a few years to do that. Most of our mining right now is mainly in that area between Scissors Creek and the original mine site of Rocanville, and we’re cutting to the west towards Scissors Creek. Eventually after that we’ll start developing out further west to take advantage of that new lease that we have purchased.

So what will the long-term plan be? Would there be at some point another shaft developed within the current lease area? Or would the next shaft to be developed be up in that new lease area west of Esterhazy?

We haven’t decided that, but that will be one of the options. We haven’t decided at this point yet on what to do. We still have to do all that planning and look at the economics. Distance does become an issue from the mill at a point, and even the service shaft where you lower employees into the underground and materials and stuff like that—distance from that will become an issue. That’s at least a decade before we make a decision on what to do there. We’ve got a lot of production ahead of us as we’re cutting west towards Scissors Creek from Rocanville.

How many years worth of potash production would there be in the current lease area?

There’s 30 years-plus of production in the current lease area. We’re pushing the west but we’re also going to the south and we still have some production to the north of the lease. So that would be 30 years-plus. By that time we’ll have developed into the new area and that production will just roll into the new lease that we’ve purchased.

I know new mines are being developed in some countries that maybe have lower costs than Canada. What does Nutrien see as the long-term outlook for potash production in Saskatchewan?

Obviously the bulk of the production is between us and Mosaic and K&S—the heavier solution mine and I know there are a few smaller projects that are looking at directional drilling-type solution mining.

The ore body in Saskatchewan is vast, so there is decades and decades and decades of production ahead of us underground, and then the ore bodies, after they can’t be mined underground anymore, they’ll probably switch to solution mining.

My children, grandchildren, great-grandchildren, great-great-grandchildren will probably have opportunities to be involved in the potash industry in Saskatchewan.

This is a world-class ore body. In my career I worked all over Canada, and I’ve worked in both hard rock and soft rock. This ore body is the biggest potash deposit in the world. You have the advantage that you’re in the middle of the continent, so you don’t have all those tectonic issues with faulting. So the ore body is very conducive to high productivity mining like we do and Mosaic does as well.

Saskatchewan will probably benefit from 100-plus years of potash mining ahead of it. At some point it will probably stop being underground mining and be more solution mining, but that’s in the far distant future. That’s kind of when you’ll be cleaning up some of the more challenging areas to mine.

The ore body in general—like at Rocanville as an example, and it’s a general trend within the entire ore body—as it goes south it gets deeper. So that’s more or less why K&S Bethune and Mosaic Belle Plaine are solution mines because the ore body is getting deeper and it’s more challenging to use mechanized mining.

What are the advantages of Saskatchewan for the mining industry? And what are the challenges the industry faces in terms of investing here as opposed to other jurisdictions?

We have a great workforce. We have skilled people, such as the trades, we have universities that are putting out engineers and geologists and chemists and chemical engineers, accountants, and all those skillsets—everyone that we need to run our business. So the universities are important, the trade schools are important, to have all those trades available to us.

From the standpoint of the supply chain, I’ve worked at remote mine sites, in Baffin Island and at the Ekati diamond mine outside of Yellowknife, and the fact that here in Saskatchewan we can call up a fabricator or a service provider or supplier in Saskatoon and they can hotshot a truck out to one of our minesites or fabricate something for us within a couple of weeks, that is a huge advantage in Saskatchewan. It’s one of the strongest supply chains I’ve worked with in my career in Canada. All my mining career has been in Canada, and I’ve worked in a few different places. The supply chain is a massive advantage for us.

Having the universities in Regina and in Saskatoon are a huge advantage to have access to those graduates in all the different skillsets—that’s a huge advantage.

The people who run our operations, and the suppliers and service providers who keep us going—those are the big advantages I see in Saskatchewan—those two aspects.

Are there other ones? Yes, but I’d say from the standpoint of disadvantage, it would be great if we were closer to the ocean—either ocean—because we have to rail it across the country to get to a port to ship it to our overseas customers—South America, Asia. It would be nice if we were closer to the water, but we’re not. We’re really reliant on CN and CP to deliver our product to the ports.

We’re always monitoring both federally and provincially the regulations and taxation issues. To be honest with you, it can become challenging for us potentially. But we’re always talking to the government and we’re always interacting with those key stakeholders to remind them that we have to remain competitive because we’re competing against the Russians and the Belarussians and some smaller organizations around the world. But our biggest competition really are the Russians and the Belarussians.

How is Saskatchewan positioned to compete right now?

We’re in pretty good shape. They have some advantages from their cost structure. The ruble in Russia has devalued quite a bit, so that’s an advantage for them. They’re not under the same regulatory regime structure that we are in Western Europe and North America, whether it’s environmental regulations or taxation. But we manage our way through those things. We have a good relationship with the government here in Saskatchewan and we maintain an open dialogue with them.

We’re a company that exists partially to make profits and sure we’d love to have lower taxes, but at the same time we’re part of the community so we understand we have to bear our portion of taxation.

I think what helps us to compete against the Russians and Belarus is really our skillset with the people we have here in Saskatchewan and innovation and a drive to be the best, most efficient mining operations in the world.

We deal with some of those other issues I talked about. Does it make it challenging? Is it maybe a disadvantage for us? I don’t know if I’d would want to call it a disadvantage, but we have to work hard to make sure that we can compete. And we are competing. A lot of it is due to the efforts that our folks put in to help keep us competitive.

People sometimes underestimate the value of having universities in your area. For us as employers it’s great to have access to those people from the universities. They drive a lot of the innovation that goes on within our business and that’s critical.

We have to always be innovating, we have to always be looking at ways to drive our cost down.

That’s just critical for us to maintain competitiveness.