Maguire’s Bill C-208 passes third reading, moves before the Senate

Widely supported bill will make it easier for small businesses, farms to be sold to family members

May 17, 2021, 4:09 pm

Kevin Weedmark

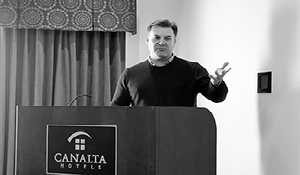

A bill brought forward by Brandon-Souris MP Larry Maguire cleared the third reading in the House of Commons on Wednesday and is now before the Senate.

Bill C-208 would make it easier for farmers and small businesses to pass their businesses on to family members.

Currently, when capital stock in a farm or business is sold to third parties, it is taxed as a capital gain. But if that same stock is transferred to family members, it is taxed as a dividend. The tax rate is lower for a capital gain than it is for a dividend. Bill C-208 would bring in the same tax rate for stock transfers to family members as long as the person taking over keeps the business for five years or more.

Bill C-208 cleared third reading in the House of Commons Wednesday by a vote of 199-128. All the Conservative, NDP, Bloc, and Green Party MPs who voted were in favour, as were 19 Liberals and four Independents.

Maguire says the issue with capital stock transfers to family members being taxed differently has been a long-time problem that needs to be addressed, which is why he introduced the private members bill.

“I don’t know when it first came in, I don’t know when the differential took place, but this levels the playing field for families that want to transfer a business, a small business, a qualifying small business—let’s be clear on that—to their own children,” Maguire told the World-Spectator last week. “It has been this way for decades and those who want to sell to their own son or daughter or grandchildren, right down the family history, are put at a great disadvantage when they sell their small business, farm, fishery or any other small business. It could be a corner store, a grocery store, dress shop or bakery, or even an insurance office. It’s put them at a detriment, tax-wise, to be able to sell to their own families versus a complete stranger.

“There are tax rules in place and this bill doesn’t prevent Revenue Canada or anybody from doing an audit of any business any day of the week or year. But it’s true that if you sell to your own family, the net profits from the purchase price that you originally paid for your business to the sale price is taxed as a dividend at about 44 per cent, or up to that, if you sell it as an individual. Whereas if you sell to a complete stranger, you then as the family selling you get to use the capital gains exemption that’s there. Whereas you don’t get to use it if you sell to your own family.

“So there’s a huge difference in taxation of about, sometimes over $400,000 on a $1,000,000 operation, and most of the time the family that’s grown that business has pumped all the profits back into growing it, and so this is basically their retirement package when they leave the business.

“But we know of lots of businesses that have not been able to sell to their family because they had to have that money to retire on and it becomes prohibitive for their family, there just aren’t enough resources there to be able to have them pay it as pre-tax funds. They have to pay the tax on those dollars to be able to purchase that business anyway. So it puts them at a disadvantage versus someone who’s a complete stranger.”

What was the justification or reason for that differential coming in, in the first place?

“I think they felt there could be situations where maybe these businesses would be transferred without the dollars actually being transferred and that’s why I say that there are stop gaps and safeguards put in this bill to prevent that,” says Maguire. “If this transaction was to take place just to get the use of that capital gains tax and the financial implications were not transferred, then the family would have to go back and pay the taxes as if it’s been taxed as a dividend anyway, and so that’s a huge detriment to any family wanting to be able to make this operation work. The last thing we want is a fraudulent situation. So that’s why the safeguards were built into this bill.”

Maguire is hoping the bill will be approved by the Senate by the end of June. He says he is optimistic the bill will be approved by the Senate.

“We had complete full opposition support of this bill, and for the first time yesterday (Wednesday) we started out with only two members of the Liberal party voting for this in second reading, but at third reading yesterday we had 19 Liberals that did vote with it as well, and I think the Senate can see that.

“There’s different groups in the Senate as well but every constituency in Canada, all 338 of them, have small businesses in their ridings and their provinces from the Senate side. So I think it’s important to every member of the Senate as well and that’s the indication I’ve had so far.

“We would hope that it would pass before the Prime Minister calls an election because all of these bills would die on the order paper and have to start over again in a new Parliament if there’s an election called, and so there’s some need to be able to move this forward.

“I want to thank my colleagues in Saskatchewan, both Mr. (Andrew) Scheer and Mr. (Randy) Hoback, for allowing me to move my bill forward into their time slots. I think Andrew’s own bill was up here this week as well, and Randy and he both know the importance to small business of this moving forward, and due to their co-operation with me on this, this is why we’ve been able to move this bill forward as quickly as we can and get these votes done in the House, so it may have an opportunity. It is, as I said, supported by all the opposition members in the House and now a good deal of the Liberal party as well. We’re hoping that the Senate will deal with it expeditiously as well.”

Why does Maguire this it’s so important for the bill to pass?

“Well number one, it is to make sure that you level the playing field and that’s all this bill does,” he says. “It doesn’t give anybody an advantage, it just takes away the detrimental tax treatment of selling to your own children and it levels the playing field. I think that tax fairness is always a situation that we should look at in Canada and these dollars then stay in the local community as well. Because if your children take over your business, you’re probably not going to be too far away from the grandchildren if that occurs, or your own family.

“I haven’t farmed for 20 years but you’ll never take the interest of agriculture out of my life and so I think it’s a big part of it. But make no mistake, this is not just about farming, it’s about the fisheries on our coasts as well as inland and every small business that is affected by this in Canada.”

Maguire says he’s getting major support for the bill from across Canada.

“It’s huge,” he says. “All these general farm organizations, like APAS and Keystone Ag Producers on the Prairies and across Canada. I just did an interview in Southern Ontario on this as well, the Canadian Federation of Independent Business has been very supportive, the Insurance Brokers Association of Canada, the Canadian Life Association, the Board of Trade in Montreal, Canadian Tax Payers Federation, the Canadian Chamber of Commerce, the Canadian Federation of Agriculture, Grain Growers of Canada, Western Canadian Wheat Growers, Canola Growers of Canada.

“All these organizations have been behind this bill, and make no mistake it did come forward in 2017 but it was defeated by the Liberals in those days. And Guy Caron, the former interim leader of the NDP brought it forward, and I looked at what changes we might do with that when we came back in. Unfortunately for Mr. Caron, he was not re-elected in Quebec in the last election and I was lucky enough to be drawn in the first 20 private members bills that had the honor of being able to come up in the House of Commons since the 2019 election, and so that’s why we were able to pick it up with his discussion, word for word basically, and move this forward.

“So it’s a very non-partisan effort on behalf of small businesses across the country.”

How rare is it for a private members bill to pass all the way through the House of Commons?

“There’s not that many that do get support like this to pass through,” says Maguire, “ but we have full support of the opposition parties, the Green party, the Block, the NDP, and ourselves, as Conservatives, and as I said 19 Liberals yesterday voted for it, and many of the independents as well.

“It’s not always that these bills go forward, some of them are defeated at second reading in the House and they don’t go any further. So I thank all my colleagues in the House of Commons for the support that we’ve had so far and look forward to the presentations in the Senate when the time comes as well.”

Maguire says it feels good to see the bill pass through the house.

“I’m happy,” he says. “I’m very pleased to see it go forward. Being a small business person all of my life myself, I know the importance of it, and so that’s who’s going to benefit the most from this. And it’s not just them (that will benefit), because as I said, any of these dollars that are saved stay in those communities, and we all know that small communities and cities survive in Canada because of volunteers. And if the people are allowed to make a living and stay in those communities, then they are there as volunteers to help keep those communities going, and I think that’s the big plus for the whole country.”

APAS applauds bill passing

The Agricultural Producers Association of Saskatchewan (APAS) said they are very pleased Bill C-208 passed in Canada’s House of Commons on Wednesday afternoon.

“The passing of this bill in the House is good news for producers in Saskatchewan and across the country,” said APAS President Todd Lewis. “For too long, it’s hasn’t made sense that it’s cheaper to sell your farm to a stranger than to your son or daughter.”

Bill C-208 will amend the Income Tax Act, making it more affordable for producers to sell their farms to a family member instead of selling to a non-family member.

Right now, when a producer sells their farm to a family member, the sale is considered a dividend between the original purchase price and the sale price. However, if the producer sold their farm to a non-family member, the sale would be seen as capital gain, which is taxed lower than a dividend.

APAS estimates 95 per cent of Saskatchewan farming operations are family-owned and operated. The number of producers nearing retirement is increasing, and APAS says many of these family farms want to transfer their assets to a family member to maintain the farm as a family operation.

APAS sent a submission to the House of Common’s Standing Committee on Finance on March 4 expressing its support for the bill.

“Bill C-208 represents an opportunity to address this longstanding inequity that has negatively impacted the transition plans of family farms in Canada,” Lewis said in March.

As the bill moves to the Senate, APAS says it wants Canada’s senators to recognize the importance of this bill and its potential positive impacts for the country’s agricultural sector.