Saskatchewan and Manitoba carry the cheapest car insurance rates in Canada

January 25, 2023, 1:34 pm

Sierra D'Souza Butts

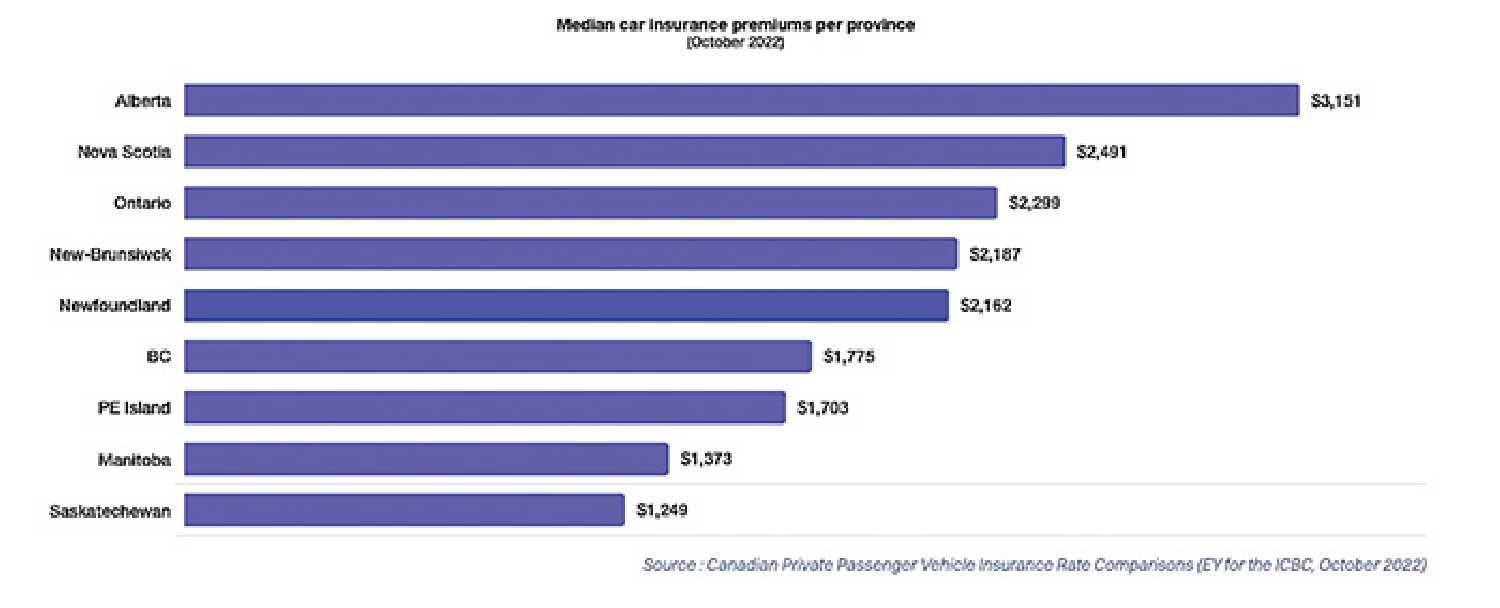

Based on Canada’s car insurance premiums barometer of 2023, HelloSafe found that Saskatchewan and Manitoba are the two provinces with the lowest car insurance premiums in Canada.

As of the end of 2022, it was found that drivers in Manitoba pay an average of $1,393 for car insurance, as residents in Saskatchewan pay an average of $1,249 for car insurance.

“Manitoba and Saskatchewan have lower car insurance premiums than in other provinces because of their public car insurance systems,” said Alexandre Desoutter, spokesperson for HelloSafe Canada.

“The Manitoba Public Insurance (MPI) and the Saskatchewan Government Insurance (SGI) makes those organizations able to maintain low prices, when in other provinces the sector is not so regulated.

“For example, in Alberta, the car insurance market is private. We observed big jumps in premiums in 2022, which now makes that province the most expensive for car insurance in Canada.”

From the report, Calgary and Edmonton are, by far, the cities where drivers pay the more car insurance premiums in Canada, with a respective annual median premium of $3,182 and $3,150.

Cities such as Winnipeg ($1,381), Brandon ($1,320) and Saskatoon ($1,249) are among the 10 cities in Canada where drivers benefit from the lowest car insurance premiums across the country.

HelloSafe was asked what makes cities like Winnipeg and Saskatoon different than a city like Toronto, where insurance is drastically higher.

“What we said about Manitoba and Saskatchewan in the previous answer, also applies to Winnipeg and Saskatoon as cities,” said Desoutter.

“Drivers in those two cities enjoy fairer premiums than in Toronto thanks to the MPI and SGI regulations that prevent premiums from rising too much.

“It is also a fact that crime and accident levels are higher in Toronto than in Winnipeg or Saskatoon, given the fact that it is a metropolis of almost 6 million inhabitants. That also explains that car insurance premiums are so high in Toronto, in comparison with other cities in Canada.”

HelloSafe’s report was made with available data on car insurance premiums for a total of 33 Canadian cities located in nine different provinces, for 27 different profiles of drivers - mixing criteria such as gender, age, marital and employment status, numbers of years of license, history of claims and convictions, distance of commute, annual kilometers driven and the car type and model.

“As a financial products comparison platform aiming to help millions of Canadians every year to make the most out of their wallet, HelloSafe produces information on topics relating to personal finance in Canada in order to raise awareness on complex subjects for consumers and to provide everyone with the latest information,” said Desoutter.

“This is the reason why we regularly carry out studies on trends relating to car insurance in Canada.

“This report will benefit drivers in Canada because they will be able to see whether they pay high car insurance premiums or not in comparison with the rest of the country.”

The report also found that Canadian male drivers pay on average 4.1 per cent more in car insurance than female drivers.

The full report can be found at Hello Safe.